Oil suffers deep weekly losses amid rising concerns about demand. US data showed weaker gasoline consumption, higher oil inventories. Ivia restored production and exports to ease market tensions

Oil faced nasty weekly losses on mounting evidence that the global economic slowdown is fueling demand destruction, with prices falling to their lowest levels in six months as key time spreads narrow.

West Texas Intermediate crude has traded above $89 a barrel in Asia, with US benchmark oil down more than 9% this week. Official data showed that US gasoline consumption declined while crude oil inventories rose. The fall came even after Saudi Arabia hiked prices and OPEC+ warned of a capacity shortage.

While oil markets remain in backwardation, a bullish pricing pattern, widely observed differentials have narrowed sharply, signaling an easing near-term supply shortfall. Brent’s nearest spread – the gap between the two closest contracts – was $1.62 a barrel backwards from more than $6 a week ago.

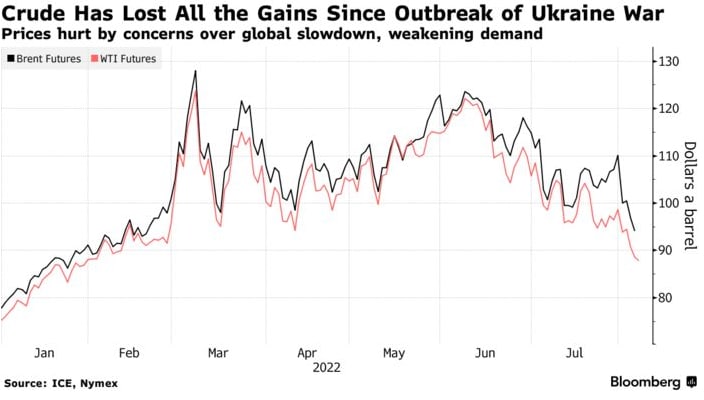

Prices have been hit by fears of a global economic slowdown and weakening demand

After a sharp rise in the first five months of the year, the crude oil rally has reversed and losses have intensified this month after falling in June and July. The sell-off, which wiped out gains from the Russia-Ukraine conflict, will ease inflationary pressures gripping the global economy that have prompted central banks, including the Federal Reserve, to raise rates.

“The market is still struggling with the deteriorating US demand picture, with pressure on its refining capacity easing significantly,” said Stephen Innes, managing partner at SPI Asset Management.

WTI for September delivery added 0.9% to $89.29 a barrel on the New York Mercantile Exchange at 7:36 am in Singapore. The price of Brent crude for October delivery rose 0.7% to $94.78 a barrel on the ICE Futures Europe exchange.

The move to a much tighter monetary policy has raised investors’ fears that global economic growth will slow, jeopardizing energy prospects. The Bank of England has warned that the UK is headed for more than a year of recession as it has raised borrowing costs, while in the US, a procession of Federal Reserve speakers have vowed to continue their aggressive fight against inflation.

China also showed signs of weakness, clouding the prospects for crude oil consumption by the top importer. The latest data showed that factory activity has dwindled and China Beige Book International warned of a worsening economy.

This week’s decline was partly due to Libya resuming production after a period of turmoil, potentially stabilizing the OPEC member’s exports at more than 1 million barrels a day and easing market tensions.

On Wednesday, the Organization of the Petroleum Exporting Countries and its allies, including Russia, agreed to a modest increase in collective deliveries in September, while warning that its spare capacity is extremely limited. Saudi Arabia, the de facto leader of the group, has raised oil prices to buyers in Asia to record levels.